How to turn birthday money into a Bright Start future

From the moment a grandparent holds a grandchild for the first time, they're already dreaming of the future – and maybe thinking about opening a little savings account for a rainy day.

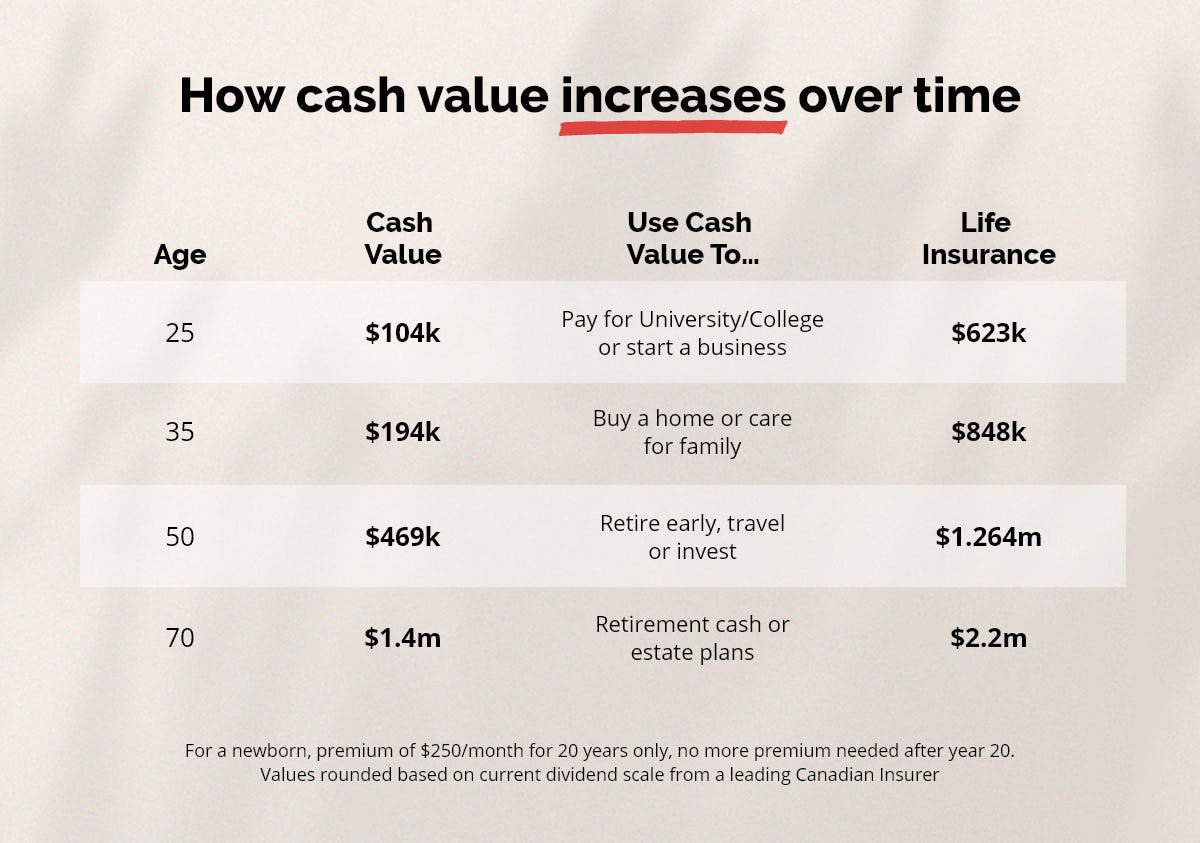

For grandparents (and parents), the future could include watching the child graduate university or launch a business, start a family or buy a home. Either way, one thing is for certain: you always want to be right there, celebrating the moment with them.

But what about if you could do something now to remove financial barriers in the future? With a Bright Start plan, parents and grandparents can put aside a little now that will create the big moments later.

Imagine watching a grandchild accept their university degree in their gown and cap, knowing they're debt-free. Or making a downpayment on a home that you saved for them by putting that birthday money into a plan for the future.

How does it work?

Start with an amount of discretionary income you feel comfortable with investing, like $250 a month over an 8-, 10- or 20-year payment period.

Over time, the cash portion of the policy builds and returns increase, so that by the time you sign over the policy at the end of the payment period you chose, your child or grandchild will be starting life with a solid financial footing.